The primary aim of these loans is to empower housewives to achieve financial independence and have the power to contribute economically to their households.

The primary aim of these loans is to empower housewives to achieve financial independence and have the power to contribute economically to their households. While the eligibility criteria can differ from lender to lender, many housewife loans think about various earnings sources, corresponding to savings or support from members of the family. This flexibility makes it simpler for homemakers to safe funding without the burden of traditional mortgage functi

On BePick, customers can discover insightful articles that break down complicated mortgage terms and conditions into simply comprehensible language, making it simpler to understand the necessities of housewife loans. Furthermore, the web site options user-generated reviews that present valuable views from those who have beforehand obtained loans, helping potential debtors learn from their experien

Managing Your Personal Loan Effectively

Once you secure a private loan, managing it responsibly is important to sustaining your financial well being. Set up automated funds to avoid missed deadlines, which might incur late fees and negatively have an effect on your credit score sc

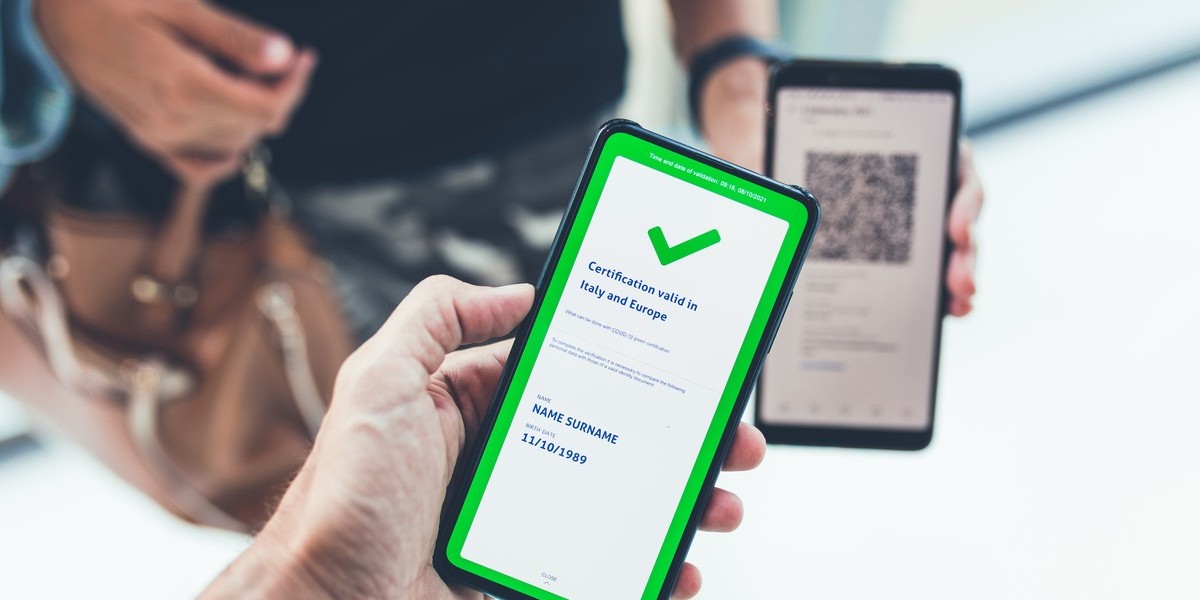

Yes, no-visit loans could be utilized for a big selection of purposes, together with medical expenses, home improvements, debt consolidation, or emergency bills. Lenders usually define any restrictions on use in their mortgage agreements, but many supply flexible terms that enable for various {applications|purposes|functio

After submitting the applying, lenders will review the information provided, which can include a credit examine. If permitted, the borrower will obtain loan phrases and agreements outlining interest rates, reimbursement schedules, and any relevant fees. Once the borrower agrees to the phrases, the funds will be disbursed, permitting for immediate

Utilizing BetPick for Informed Decisions

In the vast world of economic information, finding a credible source may be daunting. This is where BetPick stands out. BetPick offers detailed insights, evaluations, and details about Loan Calculators that can improve your borrowing information. The platform covers numerous types of loans and presents comprehensive comparisons that may guide your mortgage choice course of successfu

Additionally, reliance on {technology|know-how|expertise} {means that|signifies that|implies that} {borrowers|debtors} {may|might|could} encounter challenges {related|associated} to {the online|the web|the net} {process|course of}. Technical {issues|points} or difficulties navigating {online|on-line} platforms can {lead to|result in} frustration or delays. As {borrowers|debtors} {move|transfer} {forward|ahead} with their {applications|purposes|functions}, they {must be|have to be|should be} {prepared|ready} {to address|to deal with|to handle} any such {issues|points} promp

Next, think about the mortgage's rate of interest and related fees. Understanding the entire cost of the mortgage, including any origination charges or prepayment penalties, is essential for making an knowledgeable determinat

Women's Loans play a vital position in promoting monetary independence amongst ladies. By offering accessible funding, these loans empower women to take cost of their monetary destinies, whether or not via beginning a business, pursuing training, or managing personal expenses. The ripple effect of monetary independence is profound, impacting not solely particular person lives but additionally families and communities at la

Most Loan Calculators additionally provide further insights like amortization schedules, which break down every payment into curiosity and principal over the life of the mortgage. This function may be significantly useful for debtors who want a clear image of how their funds will reduce their

Debt Consolidation Loan over time. Understanding your loan dynamics via such a lens can alleviate the worry of unmanageable debt and promote responsible monetary plann

Additionally, private loans provide mounted rates of interest, that means your month-to-month funds stay constant all through the life of the mortgage. This predictability can assist in budgeting and financial plann

Moreover, bearing in mind other monetary obligations—such as bank card debts, existing loans, and

Same Day Loan by day residing expenses—will provide a extra correct picture of your monetary well being. With this data, you'll have the ability to adjust the parameters in your Loan Calculator to reach at a figure that will not jeopardize your financial stabil

Online platforms, similar to blogs and forums dedicated to ladies in business, also can function useful assets. They not solely present information on obtainable loans but in addition share experiences from other girls who have successfully obtained financing. Networking events and seminars offer opportunities to attach with mentors and other businesswomen who can provide insights and steer

Similarly, personal mortgage calculators could focus solely on loan

Small Amount Loan and interest rate because they usually don't involve the identical costs associated with property ownership. Understanding these distinctions will guide you in choosing the best calculator in your needs, guaranteeing you're equipped to make knowledgeable choices based on correct d

Ensuring Safe Online Sports Betting with the Reliable Scam Verification Platform toto79.in

על ידי gvmlarry556523

Ensuring Safe Online Sports Betting with the Reliable Scam Verification Platform toto79.in

על ידי gvmlarry556523 Купить свидетельство о браке.

על ידי lorenerau57736

Купить свидетельство о браке.

על ידי lorenerau57736 Купить диплом с внесением в реестр.

על ידי kristopher3206

Купить диплом с внесением в реестр.

על ידי kristopher3206 Купить диплом пгс.

על ידי lewissunderlan

Купить диплом пгс.

על ידי lewissunderlan Купить диплом с реестром отзывы.

על ידי paulettewhitlo

Купить диплом с реестром отзывы.

על ידי paulettewhitlo