Improve Your Credit Score: Before applying for a secured loan, take steps to improve your credit rating.

Improve Your Credit Score: Before applying for a secured loan, take steps to improve your credit rating. Pay down present debts, appropriate any inaccuracies on your credit report, and ensure well timed payments on other monetary obligati

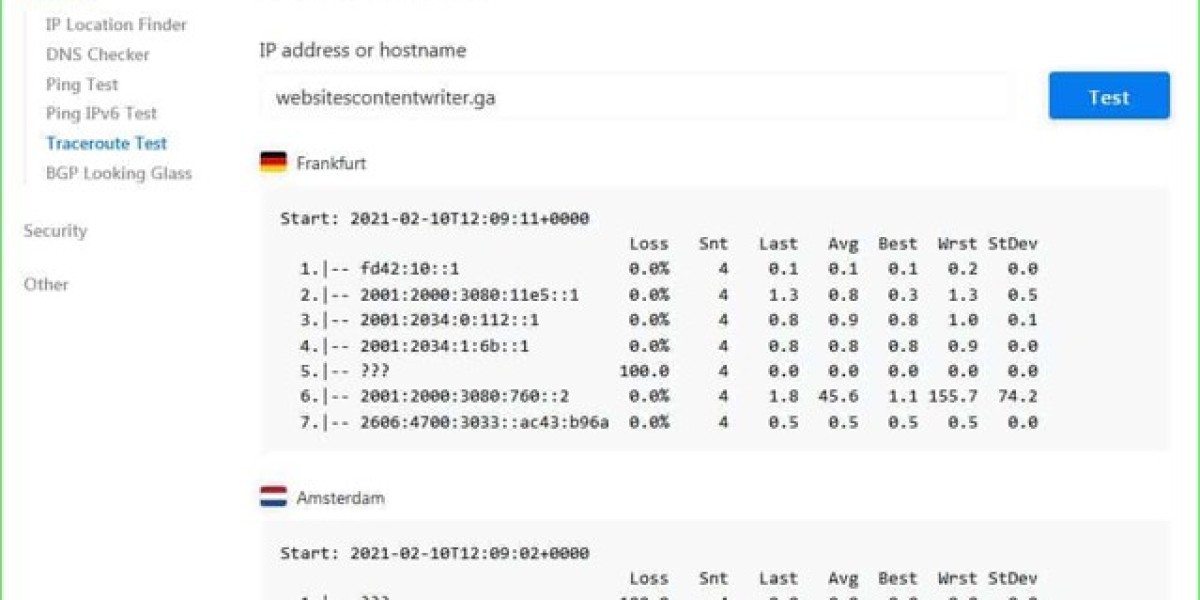

When providing private details on-line, look for indicators of sturdy cybersecurity measures, similar to encrypted net pages. Additionally, understanding privacy insurance policies may help debtors know how their data might be used and protec

Utilizing Bevick for Informed Decisions

Bevick stands out as a wonderful useful resource for anybody thinking about low-interest online loans. The website provides complete data, detailed reviews, and educational content to help consumers make informed monetary selections. Users can find comparisons between different lenders, showcasing rates of interest, phrases, and customer support ranki

Additionally, learn all the fine print associated with the

Real Estate Loan. Understanding the terms, interest rates 이지론, and any relevant charges is vital for avoiding any unpleasant surprises in the fut

Finally, maintaining open communication with the lender all through the applying course of can alleviate confusion and expedite any extra requests for data. Excellent communication builds belief and readability for both part

In right now's financial panorama, secured loans are becoming more and more popular, particularly because the demand for pressing funds rises. These loans, backed by collateral, offer numerous advantages over unsecured choices, notably in phrases of interest rates and approval odds. For people navigating the world of secured loans online, it’s important to understand the key features, advantages, and potential pitfalls associated with this lending choice. This article will explore the panorama of secured loans, specializing in what they're, the appliance course of, suggestions for obtaining a greater deal, and tips on how to leverage sources just like the Bépic web site for informed choi

However, borrowers should be cautious. The danger of dropping the asset if funds are missed makes it important to evaluate personal finances and repayment capability before committing to a secured mortg

Additionally, on-line lenders usually provide a broader vary of loans and terms, allowing extra flexibility in cost options. Borrowers can find tailored options that meet their particular monetary situations, making online debt consolidation loans a beautiful selection for lots

The **ease of access** is one of the primary appeals of instant approval loans. Many lenders offer purposes available 24/7, making it convenient for individuals who may go irregular hours or produce other commitments. Furthermore, potential debtors can examine a number of lenders and select the finest choice without dealing with the challenges of in-person vis

Risk of Asset Loss: The primary threat with secured loans is the possibility of shedding the collateral when you're unable to fulfill reimbursement phrases. It's essential to gauge your monetary scenario and guarantee manageable repayme

Payday Loans: Short-term loans that are normally due on the borrower’s subsequent payday.

Personal Loans: Unsecured loans with relatively longer repayment phrases, typically structured over several months.

Title Loans: Loans secured by the borrower’s vehicle, allowing them to borrow in opposition to the worth of the car.

It's essential to rigorously contemplate the implications of every sort of

Loan for Bankruptcy or Insolvency. For instance, payday loans can lead to a cycle of debt due to their high-interest charges and brief repayment phrases. On the opposite hand, private and title loans may supply extra manageable reimbursement opti

Ultimately, understanding the variety of choices obtainable empowers consumers to make the most effective selections for his or her financial future. Whether pursuing debt consolidation or exploring alternatives, information is essential in navigating debt challenges effectiv

To consider the proper lender for a secured mortgage, think about factors such as interest rates, charges, phrases of service, and borrower critiques. Utilize comparative platforms like Bépic to assess totally different lenders. Ensure that the lender has a transparent lending course of and provides favorable terms that align along with your financial scena

Additionally, some borrowers may fall into the entice of over-borrowing out of an eagerness to acquire fast funds. It is essential to assess monetary wants realistically and keep away from taking on extra debt than may be comfortably managed. Careful planning is crucial to achieving long-term financial stabil

Advantages of Bad Credit Cash Loans

While taking over new debt is always

이지론 a major choice, bad credit money loans have distinct advantages. For many debtors, these loans can serve as a lifeline during difficult financial times. Some key benefits emb

Ensuring Safe Online Sports Betting with the Reliable Scam Verification Platform toto79.in

Por gvmlarry556523

Ensuring Safe Online Sports Betting with the Reliable Scam Verification Platform toto79.in

Por gvmlarry556523 Купить свидетельство о браке.

Por lorenerau57736

Купить свидетельство о браке.

Por lorenerau57736 Купить диплом с внесением в реестр.

Por kristopher3206

Купить диплом с внесением в реестр.

Por kristopher3206 Купить диплом пгс.

Por lewissunderlan

Купить диплом пгс.

Por lewissunderlan Купить диплом с реестром отзывы.

Por paulettewhitlo

Купить диплом с реестром отзывы.

Por paulettewhitlo